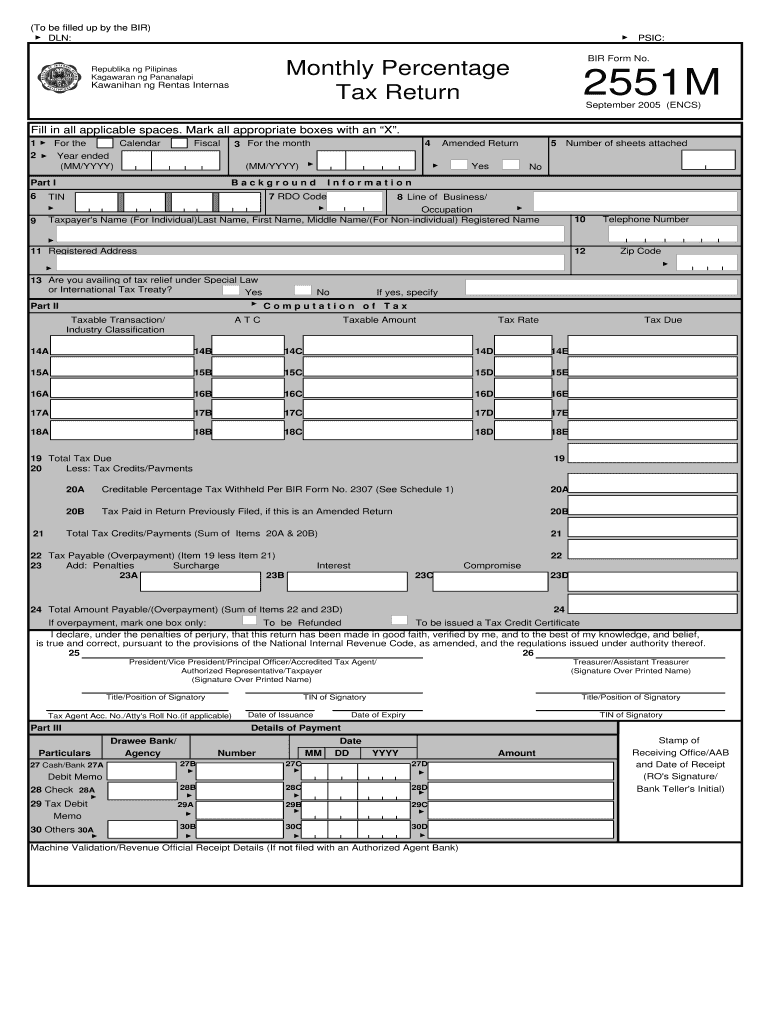

Who needs a BIR Form 2551 m?

This Monthly Percentage Tax Return, BIR Form 2551 m, must be filed by the following entities:

- Not a VAT-registered persons whose amount of annual sales turnover is not exceeding P1.500.000;

- Residents keeping garages, except bancos and animal-drawn vehicle owners;

- International air and shipping carriers operating in the Philippines;

- Franchise grantees of gas and water utilities; not a VAT-registered radio and/or television broadcasting companies with the gross annual not exceeding Ten A Million Pesos (10,000,000). Banks and other kinds of financial companies;

- Domestic insurance companies and foreign insurance agents.

What is BIR Form 2551 m for?

This form is used as a standard monthly tax return. Based on this declaration, the monthly amount of the tax is to be paid.

Is BIR Form 2551 m accompanied by other forms?

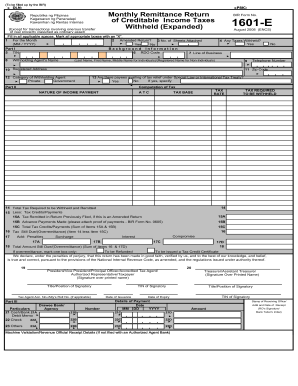

The following documents must accompany the filing of a Monthly Percentage Tax Return: Certificate of Creditable Tax Withheld at Source, if applicable; Duly approved Tax Debit Memo, if applicable.

When is BIR Form 2551 m due?

This form must be submitted before the 20th day following the reporting month. At the close of business, everyone is obliged to submit the return and pay the tax within 20 days after the close of business as well.

How do I fill out BIR Form 2551 m?

Tax period, background information on the taxpayer, computation of tax and details of payment should be specified in order to complete this monthly tax return. To the point, you may check the instruction for completing the form on page three.

Where do I send BIR Form 2551 m?

Once completed and signed, this return should be filed with any Authorized Bank within the district where the business is registered. If there is no Authorized Bank within the territory of payer’s operation, the return must be filed with the Revenue Collection Officer.